How AI Is Used In Algorithmic Trading Systems is Changing the World

Introduction to AI in Algorithmic Trading Systems

Algorithmic trading, also known as automated trading, utilizes computer programs to automatically execute a series of trades based on predefined rules. The integration of Artificial Intelligence (AI) into these systems has revolutionized the way trades are made, enabling faster, more efficient, and more profitable trading. AI algorithms can analyze vast amounts of data, identify patterns, and make predictions, allowing traders to make more informed decisions. The importance of AI in algorithmic trading systems lies in its ability to process and analyze large datasets quickly, adapt to changing market conditions, and optimize trading strategies.

Core Concepts

The core concepts of AI in algorithmic trading systems include:

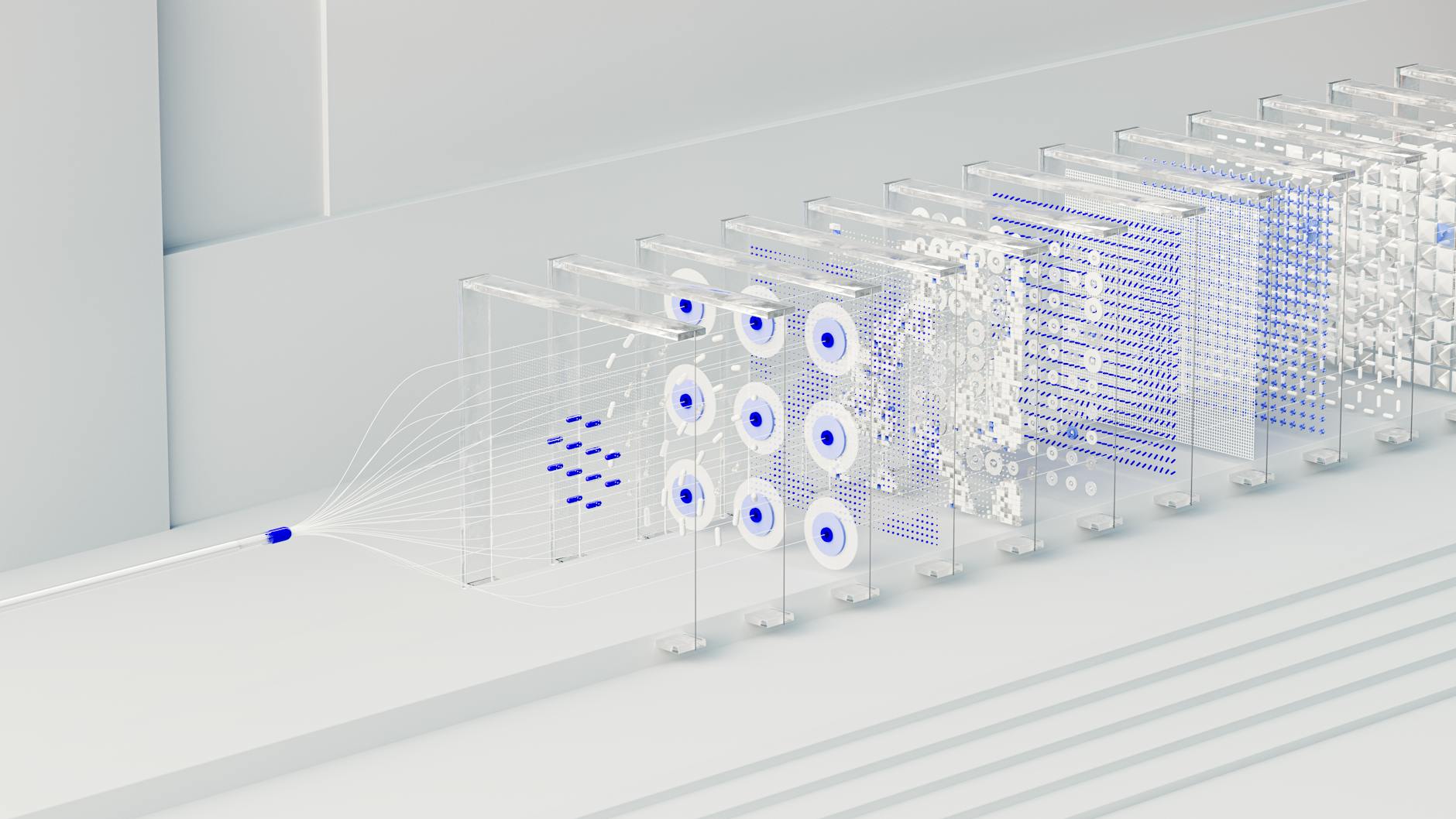

- Machine Learning (ML): A subset of AI that enables systems to learn from data and improve their performance over time.

- Deep Learning (DL): A subset of ML that uses neural networks to analyze complex data.

- Natural Language Processing (NLP): A technique used to analyze and interpret human language, often used in sentiment analysis.

- Predictive Analytics: The use of statistical models and machine learning algorithms to forecast market trends.

These core concepts enable AI-powered algorithmic trading systems to analyze market data, identify trends, and make predictions, ultimately optimizing trading strategies.

Real-World Use Cases

AI-powered algorithmic trading systems are widely used in various industries, including:

- High-Frequency Trading (HFT): AI algorithms are used to rapidly execute trades in fractions of a second, taking advantage of small price discrepancies.

- Quantitative Trading: AI-powered systems analyze large datasets to identify profitable trades and optimize portfolios.

- Market Making: AI algorithms provide liquidity to markets by buying and selling securities, profiting from the bid-ask spread.

Real-world examples of AI-powered algorithmic trading systems include:

- Renaissance Technologies' Medallion Fund: A highly successful hedge fund that uses AI-powered algorithms to generate returns.

- Citadel's Quantitative Trading Platform: A platform that uses AI and ML to analyze market data and execute trades.

Getting Started Guide

To get started with AI-powered algorithmic trading systems, follow these steps:

- Choose a programming language: Python, R, and MATLAB are popular choices for algorithmic trading.

- Select a framework or platform: Popular options include Backtrader, Zipline, and QuantConnect.

- Collect and preprocess data: Gather historical market data and preprocess it for analysis.

- Develop and train a model: Use ML and DL techniques to develop and train a predictive model.

- Backtest and optimize: Test the model on historical data and optimize its performance.

Pros and Cons

The pros of AI-powered algorithmic trading systems include:

- Improved efficiency: AI algorithms can process and analyze large datasets quickly, enabling faster trade execution.

- Increased accuracy: AI-powered systems can identify complex patterns and make predictions, reducing the risk of human error.

- Enhanced profitability: AI-powered systems can optimize trading strategies, leading to increased profitability.

The cons include:

- Complexity: AI-powered systems require significant expertise in programming, data analysis, and ML.

- Risk of overfitting: AI models can become too specialized to historical data, failing to perform well in live markets.

- Regulatory challenges: AI-powered systems must comply with regulatory requirements, which can be complex and time-consuming.

Future Trends

The future of AI in algorithmic trading systems is expected to be shaped by:

- Increased adoption of DL: DL techniques are expected to become more prevalent in algorithmic trading, enabling more complex analysis and prediction.

- Growing use of alternative data: AI-powered systems will increasingly incorporate alternative data sources, such as social media and sensor data.

- Rise of explainable AI: There will be a growing need for explainable AI, enabling traders to understand the reasoning behind AI-powered trading decisions.

Frequently Asked Questions

What is the role of AI in algorithmic trading systems?

AI plays a crucial role in algorithmic trading systems, enabling the analysis of vast amounts of data, identification of patterns, and prediction of market trends. AI algorithms can process and analyze large datasets quickly, adapt to changing market conditions, and optimize trading strategies.

How do AI-powered algorithmic trading systems differ from traditional systems?

AI-powered algorithmic trading systems differ from traditional systems in their ability to learn from data and adapt to changing market conditions. Traditional systems rely on predefined rules and do not have the ability to learn or adapt.

What are the benefits of using AI in algorithmic trading systems?

The benefits of using AI in algorithmic trading systems include improved efficiency, increased accuracy, and enhanced profitability. AI algorithms can process and analyze large datasets quickly, identify complex patterns, and make predictions, reducing the risk of human error.

What are the challenges of implementing AI-powered algorithmic trading systems?

The challenges of implementing AI-powered algorithmic trading systems include complexity, risk of overfitting, and regulatory challenges. AI-powered systems require significant expertise in programming, data analysis, and ML, and must comply with regulatory requirements.

Conclusion

The integration of AI into algorithmic trading systems has revolutionized the way trades are made, enabling faster, more efficient, and more profitable trading. By understanding the core concepts, real-world use cases, and benefits of AI-powered algorithmic trading systems, traders can optimize their trading strategies and stay ahead of the competition. As the field continues to evolve, it is essential to stay informed about the latest trends and developments in AI-powered algorithmic trading.